Dynamic Random Access Memory (D-RAM)- Examining the dynamics of an oligopolistic market

By- Ratika Gaur, Praveen Kumar, Sathya R, Nilanjan Das & Samparna Tripathy

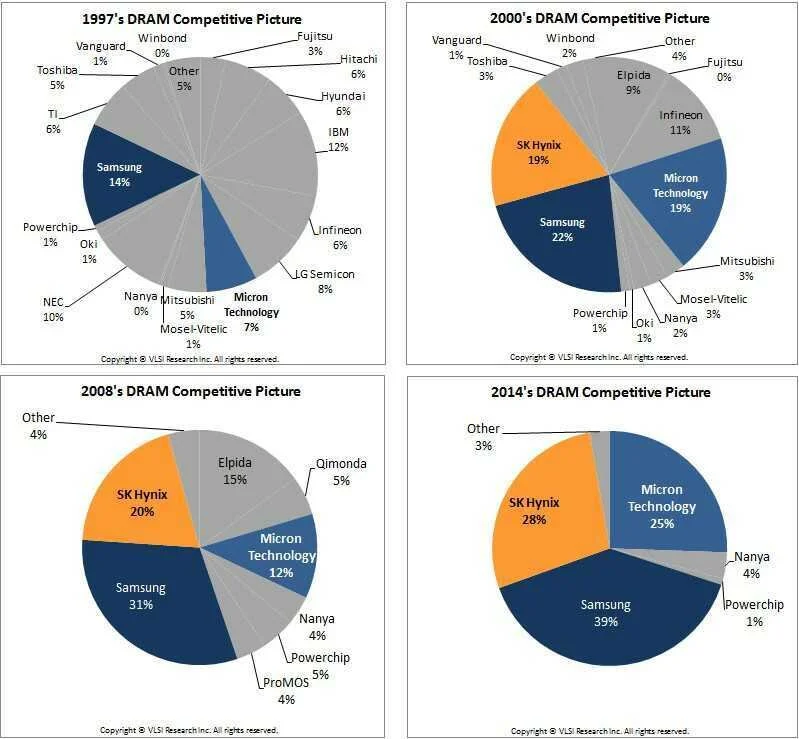

D-RAM is a memory chip that temporarily stores data when it is being processed. Today, everything from ICT to modern vehicles to energy grids and airplanes relies on access to DRAM chips. Over the past 15 years, the baton of global leadership in this industry has exchanged hands between the United States, Japan & South Korea in that order. After decades of consolidation, the DRAM market in 2019 had a volume of 62.5 billion USD, and the three leading DRAM vendors had a combined market share of 95%: Samsung and SK Hynix in South Korea (KR) and Micron in the United States (US).The level of market concentration achieved, as indicated by a Herfindahl-Hirschman Index (HHI) score of 3,221 points, easily qualifies this market to be an oligopoly.

Why did this market structure arise?

The origin of the oligopolistic market structure in D-RAM can be attributed primarily to the nature of product (similar but differentiated) & business (capital intensive & cyclical). In alignment with Moore’s law, technological innovation in the semiconductor space moves at an exponential speed resulting in short product life cycles. This implies that first movers (backed by high capital investment in technology, fab equipment & process perfection) enjoy a natural advantage. They leverage economies of scale, maximize production capacity at a fast pace, and even vertically integrate to become Integrated Device Manufacturers(IDMs) to achieve profitability. Laggards, on the other hand, find it difficult to recover their investments since they can launch products only at the mature stage where prices would have already plummeted. Hence, there’s a tendency for market players to follow the market leader(s) and participate in patent trading and cross licensing of agreements amongst themselves. As such, these factors have posed high barriers of entry for new entrants in the market.

The market has traditionally been cyclical with alternating periods of oversupply (low prices) and under supply (high prices). Economic downturns in the past have exacerbated the situation and led to companies moving out of production, filing for bankruptcy (example: Qimoda in Japan) or getting merged or acquired by the major players. This explains the market consolidation over the past 15 years.

Source: Chip History Center

What are the competition issues in this market structure?

As in any oligopolistic market structure, there is a high degree of interdependence between the major players in the D-RAM market. One firm’s output, price & non price decisions is influenced by the likely behaviour of competitors. This behaviour of oligopolists of the DRAM market can be explained using the “kinked demand theory”. In case one firm (named A) from the oligopoly increases price (above equilibrium price), rivals are not likely to follow suit and this will result in drop in market share for A. However, if A decreases its price (below equilibrium price), rivals are likely to follow suit and this will result in no substantial advantage for A (since no substantial switch by customers will take place). This level of interdependence raises uncertainty in the market and incentivizes collusion.

Source: Econ Know How

DRAM majors have been found guilty of colluding to reduce uncertainty, reduce wasteful costs for combating competition, and maximize joint profits. In Dec 2001, DRAM prices were less than 1 USD. By May 2002, prices had risen to the 4 USD – 5 USD range. Such collusion played out since firms were few and they didn’t have the threat of losing out customers. Even though gains from entering a less competitive market were substantial, entry barriers for new firms were too high. The result was that buyers (in this case, companies like Dell, HP, Compaq & IBM) suffered & so did their consumers.

What government action has been taken to address these issues?

Over the years, government efforts at tackling this oligopolistic market structure have concentrated on price-fixing & violation of antitrust laws by DRAM vendors in the US, Europe and China. The U.S. DoJ imposed fines of over 729 million USD on four companies in the 2002 investigations.

In the 80s, the United States tried to tackle the oligopoly led by Japanese firms through bilateral trade agreements (calling upon Japan to not sell chips at less than fair market value) & punitive import tariffs. Protectionist policies didn’t really yield results & the grey market flourished. However, the government initiative to establish, fund & procure from SEMATECH, a 14 member consortium of leading American semiconductor companies, did contribute in advancing tech for competing with Japan. Now, the Chinese government is also doing something similar and subsidizing land, capital investment & talent acquisition for supporting local D-RAM manufacturers.

With the emergence of new demand drivers like 5G, Cloud & AI, the global interconnectedness of the semiconductor value chain & the oligopoly’s new found conservative attitude on capacity expansion, the dynamics of this market will definitely be exciting to watch out for.

The authors are currently pursuing PGP in Public Policy from the Takshashila Institution. Views are personal and do not represent Takshashila Institution’s policy recommendations.