The Unintended: How the MSP regime induces market failures in India

By Saurabh Karamchandani and Rakesh Kumar Yadav

The MSP regime in India has been either a cause of different kinds of market failures or tended to exacerbate existing ones. In this article, we broadly focus on three of these market failures which are MSP induced - Concentration of markets , negative externalities and high transaction costs.

Minimum Support Price (MSP) has been a major policy intervention in India since its introduction in the 1960s. Since then, as a price mechanism, while never being guaranteed as an assurance by law, it has been used as a primary method of intervention in procurement cycles.

However, as is with many such market distortion activities, the unintended consequences usually compound over time ballooning into larger issues. Here in this article, we broadly discuss three market failures which are MSP induced - Concentration of markets , negative externalities and high transaction costs.

The concentration of market failures may need to be dealt with breaking the monopoly of APMCs, something which the Farm Acts 2020 intend to do. The negative externalities (depletion of ground water) require a better mechanism of allocation through water property rights, efficient pricing and mechanism to disincentivize over-use. The high transaction costs primarily require an intervention that allows farmers to transact freely out of Mandis much like open markets in other sectors do when trading supply. Informational asymmetry acts a big drag to this challenge and would require a policy change beyond the E-NAMs.

Background

Agriculture in India is a behemoth of a sector. It contributes between 19-20% to India ‘s GDP[1], employs close to 60% of India’s labour and is marred by a host of challenges. It is characterized by low growth rates, employs too many people for too little Gross value addition to the GDP, is characterized by fragmented nature of landholdings making scale production unviable, provides subsistence nature of income among a long list of challenges.

One of the major reasons for the poor state of affairs within Indian agriculture is too much state control of the entire sector and very little private sector participation. Though the benefits of market led reforms started in early 1990s have reached services and manufacturing to some extent, Indian agriculture is largely untouched by market reforms, which it so desperately needs. One of the major instruments through which the state controls Agriculture is MSP, which operates through the trio-nexus of APMC mandis, MSP and the FCI procurement.

What is MSP? A historical background

The roots of the introduction of the MSP [2]can be traced back to the embarrassment the country had to face due to food scarcity in the early 1960s with PL-480 ships from the US sending food grains. MSP thus was introduced as a floor price to incentivize farmers to use riskier High yielding varieties in the belt of Punjab, Haryana and Western Uttar Pradesh. This incentive structure worked well with India increasing its wheat and paddy production and eventually becoming what is popularly known as “Green Revolution”.

However, when introduced, the Government used to notify two sets of prices – minimum support prices and procurement price. MSP was a floor price used to provide protection to the risk-taking farmers to incentivize production whereas procurement price was the price used by public agencies. This is completely opposite to what is practiced these days where MSP is the de-facto procurement price and highest available price in the market for many grains. This has caused many market failures.

Market failure #1: Concentration of market power

The current market architecture of agriculture in many states comprises APMCs, which operates through Principal markets and sub-market yards. Each principal market has a designated area under its coverage and notified produce in these designated areas are transacted only in these regulated yards. Thus, these markets exhibit monopolistic characteristics. This regulated market architecture devoid farmers of choice of selling its produce anywhere in the market, so fundamental to modern market economies.

However, these APMC monopolies work in a peculiar manner. In a usual monopoly, monopoly by virtue of controlling supply controls prices and usually attempts to extract maximum producer surplus, APMCs enable the highest farmer surplus in the market as the APMCs procure these products on MSPs.

And don’t be misled by the name Minimum support prices, currently this is the highest available prices in the market for farmers. For the year 2016-17, as per a calculation done by Commission for Agricultural Costs and Prices (CACP) with MSP, % margin of profit on wheat is 103.9% and on paddy it is 40.7%. And this procurement by APMCs comes at the cost of a huge public exchequer.

MSPs have distorted the incentive structure for farmers. Though on paper, MSP is given for more than 20 crops (Kharif, Rabi, Calendar crops), in practice the procurement made by FCI from mandis works mostly on wheat and paddy. This is primarily due to the National Food Security Act passed by UPA under which two thirds of the population are provided wheat and rice at Rs. 2 and 3 respectively. Thus, the FCI procures wheat and rice from the APMC mandis and stores in their godown which is then distributed through the PDS system. Due to this high profit margin, assured procurement assurance through APMCs, farmers are incentivized to produce more wheat and rice year on year.

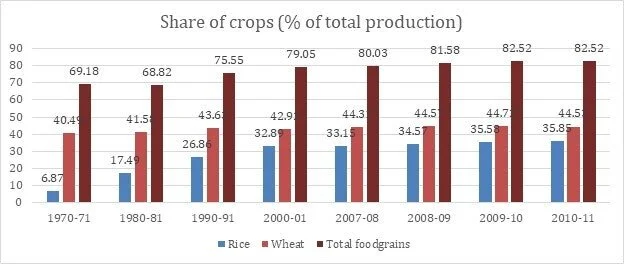

The below graph [3]documents that since the introduction of MSPs, farmers are producing more of rice and wheat even if due to higher disposable income, the demand would have moved towards pulses, oilseeds, vegetables, and fruits. Thus, the incentive for farmers has distorted the agri- markets. Rather than demand and supply dictating the markets, it is MSP which is the signal for the farmers to keep growing more rice and wheat. This is market distortion through MSPs.

Image 1: Production levels of rice and wheat in India (1970-2011)

Market failure #2: Negative Externalities

Indian Agriculture has always been marred by high input costs, low yields, shrinking profits for the farmers and a deep lack of skill & development. Several interventions in order to course correct these challenges over time have created certain negative externalities that now plague the sector.

Price subsidies in India including MSPs, it can be argued, have tended to either exacerbate the impact of existing, or introduce negative externalities, with both first order and second order effects. The first order effects are easily observable. We see immediate negative price trends once MSPs are announced, in AMPCs, leading to loss of value of crop during the sale. Ironically, the price floor ends up becoming the price ceiling at which farmers are forced to sell the produce.

Yet, it is the second order stage where the true impact of negative externalities is revealed.

Take the case of Punjab and Haryana for example. As subsidies have grown, we have seen an increasing share of Wheat and Paddy being procured from these two states. Punjab accounts for 13% of the country’s rice and wheat crop, yet 26% of what FCI procured in last cycle was from the state[4]. Indeed, one of the reasons why Punjab grows so much wheat and rice, in turn, is linked to this FCI benevolence and large quantum of subsidies.

A large part of continuation of such measures is the Political Economy of India being intertwined with the Agriculture sector and farmers at the centre of it. As farmers are an influential vote bank, several policies based on subsidies, on top of MSPs on produce such as free electricity and urea subsidy seem to resonate with the farmer base even though most of these policies are regressive and tend to benefit middle- & high-income farmers disproportionately more than the poor farmers. (Jain, Pg.8).

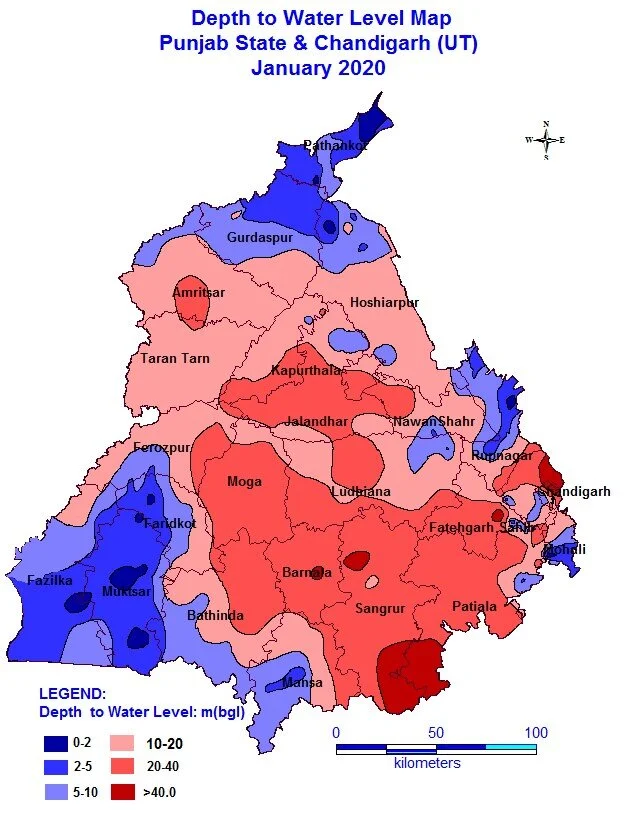

A major negative externality of such a process above has been excessive groundwater depletion in Punjab, which, more than a failure of farmers, is a larger failure of Public Policy implementation at various levels through the decades.

The design of incentives and structure of political economy create & exacerbate such externalities.

The continuing paddy-wheat cycle which traps the farmers is largely a vector which is the resultant sum of assurance of procurement through MSPs, electricity subsidy, and input subsidies. Furthermore, Lack of any property rights over groundwater disincentivizes the farmers against any potential opportunities of economizing groundwater resources. The resulting situation has led to high water table stress and groundwater depletion in the state and there seems to be now a real risk of desertification in Punjab the next few decades.

This is interaction of multiple market failures leading to another - a negative externality; a second & higher orders effects-based situation.

As per one of the studies carried out by Central Ground Water Board[5], most of the blocks in the state of Punjab are staring at massive water scarcity. In the majority of Punjab, the water table has been annually going down. As per the ground water assessment carried out, net dynamic groundwater availability resources of Punjab State are 17.46 MAF (Million Acre Feet), whereas existing draft is 28 MAF.

Image 2: Groundwater Development in Punjab,2020; Source: Ground Water Year Book Punjab and Chandigarh (UT) CGWB, GoI ,2019-2020

This is a pan-state problem for Punjab. If looked block wise, out of 138 blocks of the State, 109 [6] blocks are classified as having over exploited the ground water, 2 blocks are classified as critical and 5 blocks as semi critical. Only 2 blocks in the entire state are classified as falling within the safe category of Ground water.

Market failure #3: Transaction costs (& Information Asymmetries)

Transaction costs are what are referred to as costs that are needed to be incurred by buyers and sellers to search, move goods or bargain in a market to arrive at an optimum price of exchange.

MSPs create an architecture where farmers bring their produce to APMCs mandis and then from their FCI takes the produce to their godowns which are eventually distributed through the PDS system under the NFSA. In this system, huge transaction costs are incurred at the producer’s end.

With increasing penetration of the internet and access to technology, it would have been natural to presume that overtime transaction costs will reduce as velocity of information transmission in the markets increase. However, that hasn’t been the case entirely. While India saw its Internet penetration increase from a mere 4% in 2007 to 45% in 2020[7], yet such a boom in information and internet access hasn’t helped reduce transaction costs in Agriculture markets significantly[8] despite interventions such as E-NAM in 2016.

An IIM-A study on the Unified Market Platform (UMP) initiative of Govt. of Karnataka, ‘did not find any reduction in transaction costs or gain in marketing efficiency in the e-marketplace compared to the regular marketplace’ (Argade and Laha, Pg. 13-14)[9]. This problem forces several small and marginal farmers to depend on ‘goodwill’ of traders and other intermediaries.

It creates what is called a debt trap where farmers simply lease their lands or enter into informal arrangements with traders because they have little avenue of trading outside of APMCs and possess little information on market prices barring the MSPs (which is usually the only reliable price signal they are aware of). The farmers in order to secure sale, reduce hassle of various cesses levied by mandis end up relying more on traders.

In Punjab, for instance, the state levies an aggregate tax of 8.5% of the minimum support price at which the FCI and other agencies buy grains (Market fee 3% + rural development cess 3% + arthiya commission 2.5%). Haryana is not far behind with an aggregate levy of 6.5% (market fee 2%, development cess 2%, arthiya commission 2.5%). These unnecessary taxes and cesses, are undue transaction costs and increase market inefficiencies.

Addressing these market failures would be crucial to ensuring better remuneration to farmers and stimulating the rural economy.

Mitigating Market failures

Each of the market failures requires different sets of interventions as there is no one-solution-fits-all-scenario when it comes to Indian Agriculture.

The market failure of concentration of market power in the hands of APMCs needs to be dealt with regulation and breaking up the monopoly of APMC Mandis and giving freedom the freedom to sell their produce wherever they want. The same has been proposed to achieve through the new farm bills, which have invited spirited protests from the farmers.

The market failure of negative externalities induced by the MSPs - groundwater depletion due to power subsidy would require solutions which focus on better allocative sharing of water resources (water property rights), allowing market mechanisms for efficient water pricing & mechanisms to disincentivize excessive groundwater extraction. Pricing of these resources will bring about much needed discipline within farmers and enable optimal equitable usage.

Transaction costs & Information Asymmetries need a larger redressal mechanism. While E-NAM does create an avenue for farmers to extract fair prices, there are major gaps in a completely seamless transaction mechanism. A system similar to financial trading market may serve to increase producer surplus for farmers. The mandi taxes/cesses too incur a huge burden/stress on the agrarian system. The system of levies encourages dependence on middlemen as small and marginal farmers are forced to rely upon them to complete sale in APMCs due to technicalities involved.

While broad ideas and extensive research exists as to how to address various challenges both at macro and micro levels, the sheer inertia of status quo (stasis at policymaker’s level, knowledge gap at farmer’s level and challenges due to nature of its Political Economy, at Government Level) has led to lack of introduction of comprehensive reforms, that is, until the introduction of the three Farm Bills in 2020. The greatest roadblock to successfully implementing reform measures and addressing these market failures will be the vast array of stakeholders and policy challenges that need to be confronted, managed and moved before the sector can begin to reform.

Footnotes:

[1]https://prsindia.org/policy/report-summaries/economic-survey-2020-21

[2] Doubling Farmer’s Income committee report, Volume -4, Post-production Interventions: Agriculture Marketing (Link )

[3] State Agricultural Profile- Punjab, Link

[4]https://www.financialexpress.com/opinion/punjab-farm-subsidy-higher-than-annual-income-for-farmers-in-rest-of-country/2141854/

[5] Depleting water table data study, Link

[6]https://punjab.gov.in/wp-content/uploads/2020/11/DRAFT-PUNJAB-GUIDLINES-FOR-GROUNDWATER-EXTRACTION-AND-CONSERVATION2020.pdf[7]https://www.statista.com/statistics/792074/india-internet-penetration-rate/

[8]https://www.livemint.com/Opinion/KsEuifavdjE6KDeFcpu5AM/Can-rural-India-reap-digital-dividends.html

[9]https://iimlibrariesconsortium.ac.in/assets/snippets/workingpaperpdf/3478019062018-06-01.pdf

This article was originally published in the India Unabridged Newsletter.

The authors are students of the 29th cohort (May 2021) of our Graduate Certificate in Public Policy (GCPP). Views are personal and do not represent Takshashila’s policy recommendations.